Autumn storms cost railway £21 million in lost revenue

- Extreme weather, which disrupted train journeys last autumn, meant the railways missed out on an estimated £21 million revenue in the three months to December – according to the Great British Railways Transition Team (GBRTT).

- Despite this, total rail passenger revenue was still up slightly (+1%) compared to the three months prior. That’s because, although rolling overtime bans had an impact, fewer strikes helped to offset the loss of revenue from the storms.

- Business trips were down 6% on the previous quarter, in an unusual twist for the season, suggesting business travellers were most put off by weather disruption.

GBRTT’s Train Travel Snapshot unpicks the reasons people are travelling, and what it means for railway finances.

The latest analysis, out today (21 March), looks at the financial impact of five named storms (Babet, Ciaran, Fergus, Pia and Gerrit) which hit the UK between October and December and saw other key sectors like construction reporting effects on output.

The lost income only accounted for 0.8% of total rail passenger revenue for this quarter. However, climate change is projected to increase the frequency and severity of extreme weather, making Network Rail’s efforts to make the network more resilient to weather today crucial.

Network Rail has committed to significant spend over the next five years for improving the resilience of its assets to extreme weather and climate change.

Weather disruption is likely to have deterred business travellers the most, with autumn seeing 2 million fewer trips (-6%) for business reasons quarter-on-quarter.

The quarter also saw a 11% rise in commuter journeys compared to the three months prior, as people headed back to the office after the summer holidays, helping to boost rail revenue by £47 million.

Suzanne Donnelly, Customer & Revenue Growth Director at Great British Railways Transition Team (GBRTT), said: “As a great green option, rail is part of the solution when it comes to meeting Britain’s net zero targets. But like many sectors it’s also affected by extreme weather, especially now that many workers have more flexibility than ever over whether they travel.

“Ahead of the creation of Great British Railways, GBRTT is supporting those running train services and rail infrastructure locally to see the impact of decisions on both sides of the balance sheet as they work to deliver the things that matter most to customers, like improved reliability and communication during disruption.”

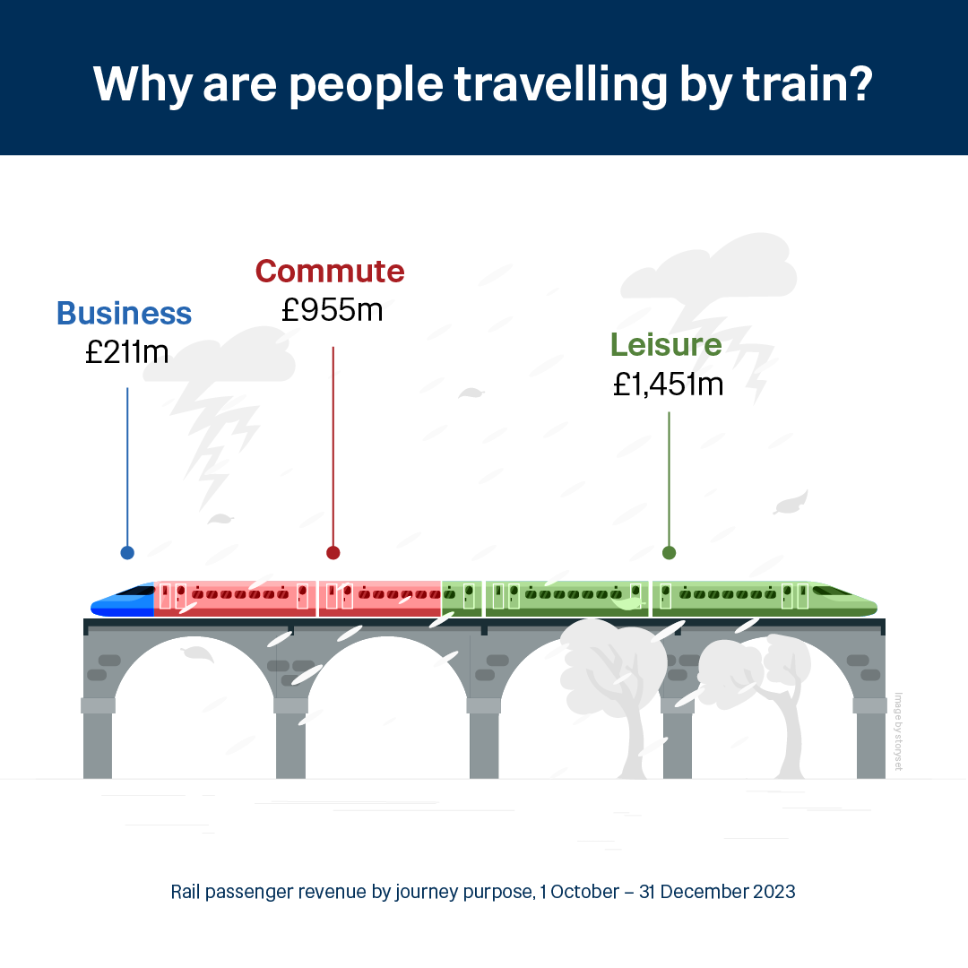

Rail passenger revenue by journey purpose, 1 October to 31 December 2023

| Journey purpose | Revenue | Revenue change from last quarter | Journeys |

| Business | £211 million | -2% | 25 million |

| Commute | £955 million | +5% | 175 million |

| Leisure | £1,451 million | -1% | 217 million |

Notes to editors

1. The figures in this release have been adjusted for inflation.

2. To calculate revenue lost to storm disruption, GBRTT take Date of Travel revenue for the last two periods and isolate the days of disruption. From the remaining 'undisrupted' days, a 'clean week' is created, which shows what we would expect revenue to be on each individual day of the week. This accounts for other disrupted days, school half terms, Bank Holidays, anything else that would have an impact on revenue for an individual day. The same method is applied for the Date of Travel refunds. The final figure is calculated by taking the difference between expected revenue in this 'clean week' and the actual revenue that fell on the storm days.

3. GBRTT’s Train Travel Snapshot Methodology:

National industry revenue and journeys figures are taken from those published by ORR each quarter. These figures and the methodology used to infer them can be found on the Passenger Rail Usage page of ORR’s data portal.

Data from the Wavelength survey has been used by GBRTT’s Passenger Revenue team to infer an estimated split of revenue and journeys by market for each quarter. These proportions have been applied to the overall ORR revenue and journeys figures. All revenue data is presented in October to December 2023 prices.

The statistics for 2024 Quarter 3 (1 October to 31 December 2023) were published by ORR on 21 March 2024, and so the figures presented in this report represent the latest available data.

The definition of business, leisure and commuter travellers is based on responses from the Wavelength survey:

- A business traveller is someone who is travelling on company business, i.e. for a work meeting

- A commuter is someone who is travelling to or from their usual place of work or education

Leisure passengers include those travelling for personal leisure reasons (e.g. visiting friends or family, days out, shopping, entertainment, sports activities, etc) plus people travelling for personal business reasons (e.g. a health appointment, a job interview or other appointment).