Britain's railways experience 10% year-on-year revenue growth

- Analysis of the latest rail statistics by Great British Railways Transition Team (GBRTT) showed revenue from rail travel grew by 10%, when comparing the second quarter this year to the same last year

- Responding to increased demand, some train companies have proactively added more trains to their schedules this December

- The quarter-on-quarter comparison indicates a maturing of rail’s revenue recovery. More strike days meant revenue for July to September only increased by 1% compared to the three months prior

- Rail still faces a sizable gap in its finances and GBRTT is calling for the industry to work together to go for growth

Released today, GBRTT’s Train Travel Snapshot continues to track the sustained recovery of railway revenue post-pandemic, revealing a 10% uplift to £2.6 billion in the three months to September, compared to the same quarter last year.

Responding to increased demand, some train companies have proactively added more trains to their schedules when the timetables changed this December.

The quarter followed typical trends for rail travel over the summer months. Despite a very modest 1% uplift in revenue compared to the previous quarter (April to June), there was an increase in revenue from leisure travel (4%).

Reflective of people going on holidays, revenue from commuting (-5%) was down slightly and while revenue from business travel (2%) was up slightly, there were fewer journeys made.

The rail sector is still grappling with a significant financial gap, and GBRTT is working with the industry to collaboratively address challenges to pursue sustained growth. The appeal is for stakeholders to work together, leveraging the current positive trajectory, and collectively addressing challenges to ensure the long-term success and viability of Britain's railways.

Suzanne Donnelly, Director of Passenger Revenue at the Great British Railways Transition Team, said: “It is hugely positive to see growth on the railways continue – not only is traveling by train more environmentally friendly but it is also better for the economy. However, we must not become complacent. There are still lots of people that we need to encourage to choose rail when they’re weighing up their travel options.

"Improving passengers’ experience will help and putting on more services is one way to do this. But we will only drive more growth by working together as an industry which is why GBRTT is supporting joined-up decision making across the whole network. We are making ticketing simpler and better value for money, and improving communications and information to customers, which is what we know passengers want.”

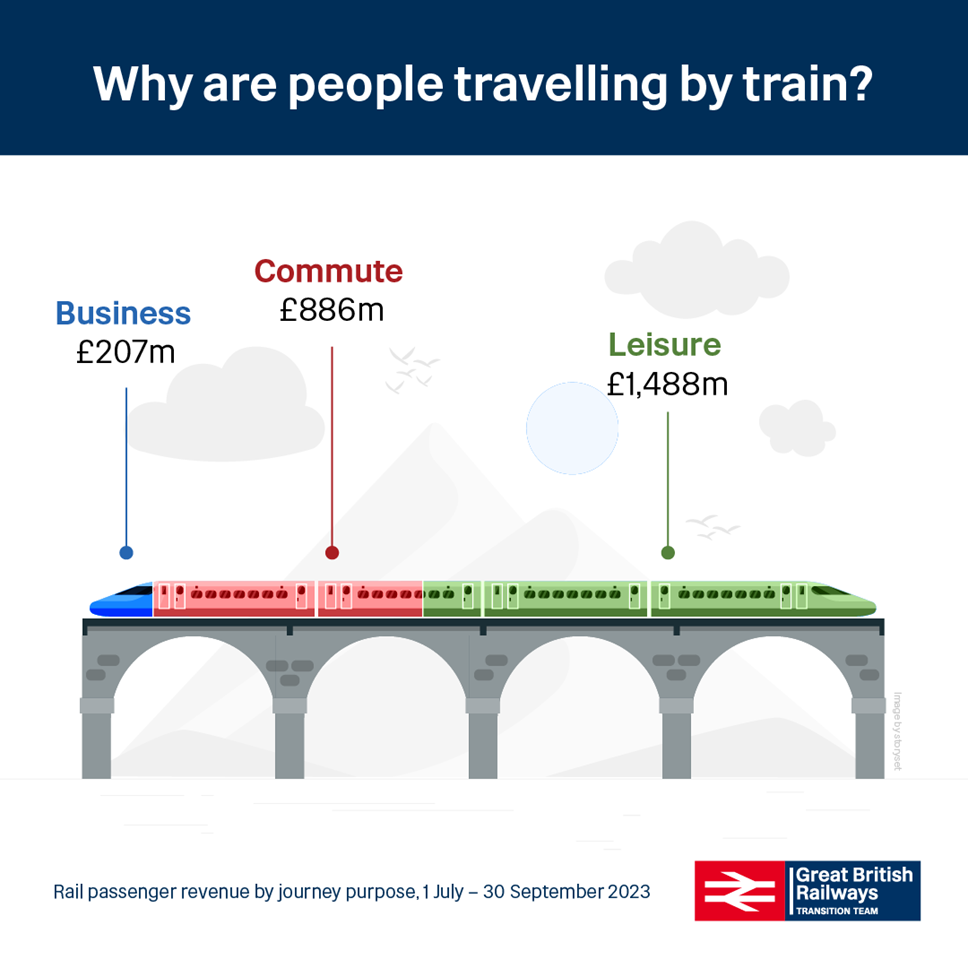

Rail passenger revenue by journey purpose, 1 July to 30 September 2023

|

Journey purpose |

Revenue |

Revenue change from last quarter |

Revenue change from same quarter last year |

Journeys |

|

Business |

£207m |

+2% |

+7% |

26m |

|

Commute |

£886m |

-5% |

+7% |

156m |

|

Leisure |

£1,488m |

+4% |

+12% |

215m |

Notes to editors

The figures in this release have been adjusted for inflation.

Previous editions

GBRTT’s Train Travel Snapshot Methodology

National industry revenue and journeys figures are taken from those published by ORR each quarter. These figures and the methodology used to infer them can be found on the Passenger Rail Usage page of ORR’s data portal.

Data from the Wavelength survey has been used by GBRTT’s Passenger Revenue team to infer an estimated split of revenue and journeys by market for each quarter. These proportions have been applied to the overall ORR revenue and journeys figures. All revenue data is presented in July to September 2023 prices.

The statistics for 2023 Quarter 2 (1 July to 31 September 2023) were published by ORR on 19 December 2023, and so the figures presented in this report represent the latest available data.

The definition of business, leisure and commuter travellers is based on responses from the Wavelength survey:

- A business traveller is someone who is travelling on company business, i.e. for a work meeting

- A commuter is someone who is travelling to or from their usual place of work or education

- Leisure passengers include those travelling for personal leisure reasons (e.g. visiting friends or family, days out, shopping, entertainment, sports activities, etc) plus people travelling for personal business reasons (e.g. a health appointment, a job interview or other appointment).