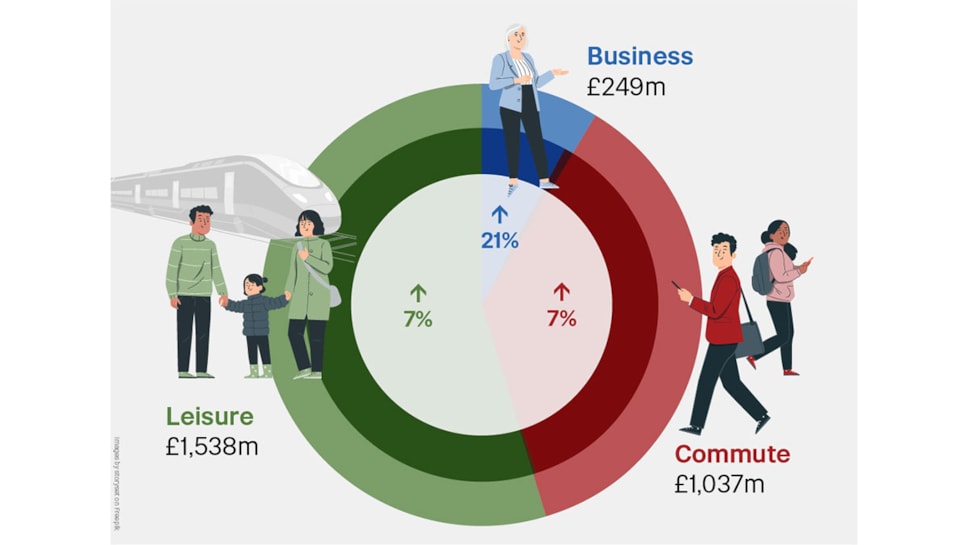

Business travel by rail grows 21% year-on-year

- Rail passenger revenue from business travel grew by 21% in April – June (Q1) 2024, compared with the same period last year, analysis of the latest rail statistics by Great British Railways Transition Team (GBRTT) shows.

- Choosing rail travel over a petrol or diesel car results in lower carbon emissions for 93.8% of business journeys across Britain, research shows.

- Commuting (+7%) and leisure travel (+7%) also saw a year-on-year uplift.

- Leisure travel boosted as global megastar Taylor Swift played to sold out crowds across the UK in early summer.

The latest Office of Rail and Road (ORR) statistics reveal that total rail passenger revenue, adjusted for inflation, was up 8% (£215 million) in April – June (Q1) 2024, compared with the same period last year, reaching a record high for both revenue and total journeys post-pandemic.

Business travel saw the most substantial year-on-year increase, up 21% (£41 million). Such a sizeable increase could reflect a modal shift to rail and a rising number of companies and individuals choosing to use the train over other transport methods to get to business events or meetings.

The Rail Delivery Group (RDG) is supporting business travellers to choose rail through their Green Travel Pledge initiative.

On 30 July 2024, RDG released data on the Rail Data Marketplace that tracked carbon emissions from over 80,000 business journeys across Britain. For 93.8% of those journeys, rail travel resulted in lower carbon emissions compared with using a petrol or diesel car.

For example, the average petrol/diesel car emissions (KGCO2e) for travelling from London to Leeds is 55.73 KGCO2e. The same journey by rail creates just 4.23 KGCO2e, meaning the carbon impact of a rail journey on this route is one thirteenth of that made by car.

RDG is urging businesses to show their commitment to sustainability by using the data to adapt travel policies, commit to environmental goals and make greener day-to-day choices.

Revenue from commuting has also continued to increase consistently since last year, which supports recent evidence that more people are going into the office on more days.

Leisure travel saw another boost, a 7% (£107 million) year-on-year increase. Leisure travel witnessed the quickest post-pandemic recovery of the three sectors and has continued to grow in Q1 of 2024-2025. During this period, Taylor Swift’s sold-out UK stadium tour led to localised surges in demand.

GBRTT’s Customer and Revenue Growth Director Suzanne Donnelly said: “It’s encouraging to see the significant increase in business travel by rail, particularly knowing the impact this has on reducing carbon emissions.

“We know there is a sizeable segment of passengers and potential passengers who value the speed of travelling by train but also the comfort, experience and ability to work on board. We also want businesses to know and shout about the greener choices they are making by choosing rail.

“The year-on-year revenue increase across business, leisure, and commuting shows once again that there is a large, credible opportunity to grow passenger volume and revenue across the country.

“Smarter, simpler and more joined-up decision making will help put the railway on a more financially sustainable footing, better able to meet customer needs and support national and regional economic and environmental goals.”

Rail passenger revenue by journey purpose, 1 April – 30 June 2024

| Journey purpose | Revenue | Revenue change from same quarter last year | Journeys |

| Business | £249 million | +21% | 29 million |

| Commute | £1,037 million | +7% | 174 million |

| Leisure | £1,538 million | +7% | 217 million |

Figures are rounded to the nearest million.

Link to time series of previous Train Travel Snapshot figures.

Notes to editors

GBRTT’s Train Travel Snapshot Methodology

National industry revenue and journeys figures are taken from those published by ORR each quarter. These figures and the methodology used to infer them can be found on the Passenger Rail Usage page of ORR’s data portal.

Data from the Wavelength survey has been used by GBRTT’s Passenger Revenue team to infer an estimated split of revenue and journeys by market for each quarter. These proportions have been applied to the overall ORR revenue and journeys figures. All revenue data is presented in April to June 2024 prices.

The statistics for 2024 Quarter 1 (1 April to 30 June 2024) were published by ORR on 3 October 2024, and so the figures presented in this report represent the latest available data.

The definition of business, leisure and commuter travellers is based on responses from the Wavelength survey:

- A business traveller is someone who is travelling on company business, i.e. for a work meeting.

- A commuter is someone who is travelling to or from their usual place of work or education.

- Leisure passengers include those travelling for personal leisure reasons (e.g. visiting friends or family, days out, shopping, entertainment, sports activities, etc) plus people travelling for personal business reasons (e.g. a health appointment, a job interview or other appointment).

More information about RDG’s Green Travel Pledge can be found here: www.raildeliverygroup.com/gtp.